Micro-generation in Ireland 2025: keep the €400 tax-free export exemption — and make it bigger

Residential solar is on the rise in Ireland. Things have changed substancially since I got my solar panels installed in May 2021. Back then it was not too common to see panels installed , there was only a few solar panel installers to choose from and you certainly did not get paid for excess electricity you sent back to the grid.

Now there are way over 100,000 residential homes with roof top solar installed, many more installers to choose from and thanks to the micro generation scheme you get paid for power you export to the grid. Homeowners who export surplus power are paid by their supplier in my case Electric Ireland @ €0.195 per kWh. The first €400 a year of those earnings is currently tax-free (Income Tax, USC, PRSI).

The exemption is only legislated to last until to 31 December 2025, with any extension expected at Budget time in October. Officials have noted rapid growth in micro-generators and a modest Exchequer cost — strong reasons to keep the relief in place.

Real bills: a typical home can exceed €400 before year-end

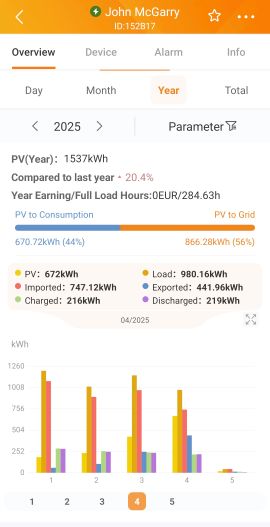

Here are my electricityy costs and export details for 2025 so far. Using a 5.6 kW residential system installed in 2021, 2025 has been a strong year — especially April to June — and export payments have already pushed over the €400 threshold with months still to go:

| Bill Date | Bill Amount | Export Fee | Units Exported |

|---|---|---|---|

| 12/8 | €37.73 | €74.30 | 381 |

| 11/7 | €90.24 | €65.72 | 337 |

| 11/6 | €55.02 | €94.58 | 485 |

| 13/5 | €49.56 | €82.49 | 423 |

| 11/4 | €71.40 | €88.14 | 452 |

| 11/3 | €155.97 | €21.65 | 111 |

| 11/2 | €186.28 | €18.53 | 95 |

| 13/1 | €221.57 | €6.24 | 32 |

| Total | €451.65 | 2,316 kWh |

That’s €451.65 on 2,316 kWh exported so far — an average of about €0.195/kWh. Many newer residential systems are larger than 5 kW, so it’s increasingly common to breach €400 well before December. How would I report my income of €51.65 , the amount over the €400 tax free limit to the Revenue?

The hassle cliff at €400

The current setup of an excemption up to €400: if you’re within the exempt amount, there’s no return to file. Once you pass €400, the excess must be declared and is potentially liable for Income Tax, USC and PRSI — which means form-filling for thousands of ordinary bill-payers over sums that are often just a few hundred euro.

Lower friction = higher solar adoption. Keep the rule simple for households and the uptake continues to climb. Residential micro-gen viewpoint

Why keeping — and enlarging — the exemption makes sense

- Adoption & climate targets. Ireland has crossed the six-figure mark for micro-generators, with residential rooftops the biggest growth lever.

- Modest cost, big impact. The Exchequer cost is small compared to the decarbonisation and grid flexibility benefits.

- Household budgets. Export credits act like natural bill relief at a time of elevated energy prices.

- Simplicity matters. A clear threshold (or full exemption) keeps admin near zero — the biggest driver of behaviour change.

- Costs of Solar PV Installation. While the costs of solar panels in ireland has come down thanks to more competition and the VAT removal, it is still expensive. This exemption is a good sales factor in encouraging people to install solar at home

Policy options that work for homeowners

- Raise the cap (e.g., to €1,000) and index it annually.

- Fully exempt residential export income at a principal private residence.

- Automatic treatment: allow suppliers to treat export payments as negative billing credits outside of income taxation for residential accounts.

Bottom line: By law, the current €400 exemption runs to 31 December 2025. With micro-gen growing fast and the fiscal cost modest, the evidence points one way — keep the exemption and scale it for residential homes.

Thinking about solar? A quick, no-obligation quote helps you see costs, grant eligibility and your likely export earnings for your own roof.

Source notes: This article reflects public reporting on the micro-generation exemption and current policy discussion, plus real household export figures from 2025.